The commercial behemoth that is the Premier League continues to flex its financial muscle. The most recent broadcast rights deal is testament to the worldwide appeal of England’s top tier, and brands continue to take advantage of its growing global footprint. In recent weeks we’ve seen a flurry of bookmaker-Club partnerships, and during the 2015/2016 season as a whole all 20 clubs had at least one gambling partner, swelling the estimated value of betting partnerships in UK football to around £70 million.

On the face of it, bookmakers’ ubiquity in English football makes perfect sense; there is a clear symbiosis between bookmakers that wish to associate with live sport, fans that are partial to a flutter, and clubs that wish to maximise the value of their own highly-sought-after sponsorship assets. However, as the number of partnerships grow and the share of voice in the betting market is spread more thinly, a bookmaker-Club partnership might not be a safe bet. Throw in last season’s relatively low return for clubs on bookmaker shirt sponsorship – the highest-value shirt sponsorship in the gambling category was West Ham United and Betway (£6m / annum; eighth out of 20); the top three overall were Manchester United (£53m), Chelsea (£40m) and Arsenal (£30m) – and the water is muddied further.

With this in mind, we have attempted to cut through the noise and make sense of the bookmaker landscape. By using Google Trends data as a proxy for bookmaker web traffic, we investigated how the share of traffic across competitors fluctuates over the course of a matchday. When are the peak times for betting traffic? Which bookmakers are most effective at stealing a greater share of the online market during those peak times? How does bookmaker exposure during televised games - via ad spots, shirt sponsorship and perimeter board exposure - influence their share of web traffic?

During the 2015/2016 season as a whole all 20 clubs had at least one gambling partner, swelling the estimated value of betting partnerships in UK football to around £70 million.

The favourites

To add some context to the bookmaker market, we’ve summarised the popularity of selected bookmakers:

From January to March 2016 inclusive, Bet365 and William Hill yielded the highest average UK search volume across the selected bookmakers, achieving about 3x and 2.3x the group average respectively (average = 1.00). Significantly, two of the top four selected bookmakers had no Premier League club partnership last season. This is especially stark in light of the proliferation of bookmaker sponsorship deals in the last year (although both Ladbrokes and William Hill have since strengthened their position in English football for the upcoming season with FA and Chelsea partnerships respectively).

But is this just a symptom of the UK betting market and the finite sponsorship opportunities with clubs? Last season’s big two ‘free agent’ bookmakers, William Hill and Ladbrokes, already own a sizable share of voice in the UK, so their recent sponsorships encompass broader objectives than simply boosting exposure. In addition, Clubs are increasingly looking to overseas partners to take advantage of the surging Premier League viewership in emerging markets. One example is betting site 138.com, Watford FC’s official club sponsor with a strong Asian presence. In terms of UK search volume, 138.com would not register on the chart above, however in some South East Asian regions, 138.com’s search volume is greater than that of Betway and BetVictor, and is growing.

When Saturday comes

The build up to 3pm kick-offs represents a gold rush for would-be gamblers, with four of the five bookmakers’ search volumes peaking in a narrow window either side of 3pm.

By collecting Google Trends data at 16 minute increments during matchday, we can see the share of the betting market through both a gambler’s and marketer’s lens. How does share of search volume fluctuate during the most important times, and how does a bookmaker’s sponsorship and advertising drive these fluctuations?

Below is a chart of search volume on a typical Saturday afternoon for selected bookmakers across a selected matchday as well as a 5-month average:

At a more granular level, we get a feel for the dynamics of search volumes on matchday. Broadly speaking, the build up to 3pm kick-offs represents a gold rush for would-be gamblers (think of those impulse accumulators), with four of the five bookmakers’ search volumes peaking in a narrow window either side of 3pm. In addition, there is relative uplift around kick-off and half time of the early and late televised games as roughly 1 million viewers on average tune in.

The 2-fold: Sponsorship and TV advertising

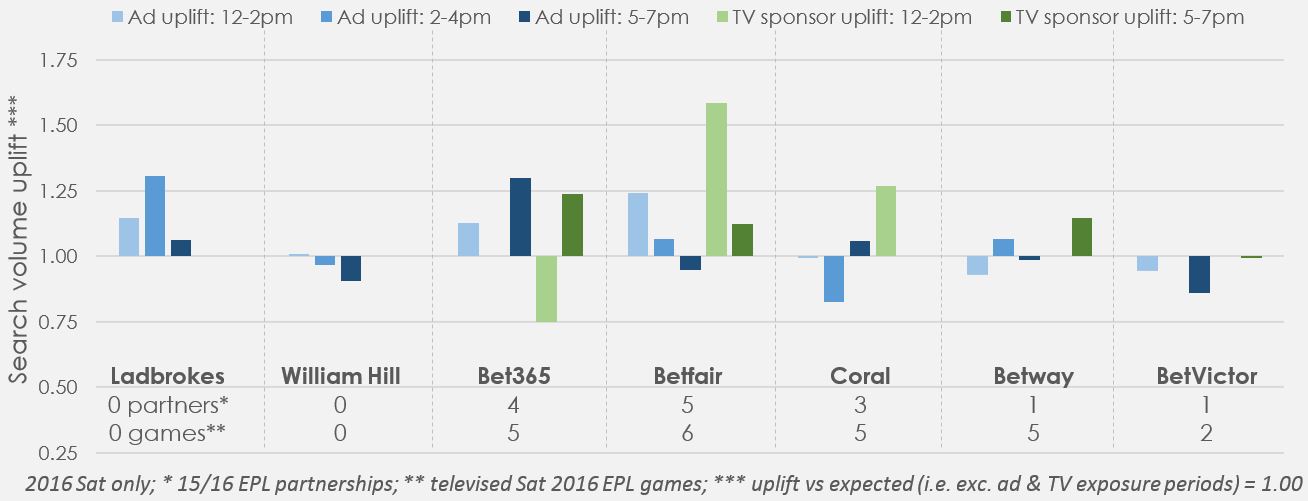

Is the largest search volume entirely borne out of the largest marketing budget? Below is an evaluation of the effectiveness of sponsorship and advertising in terms of search volume, taking into account: 1) televised matches where bookmaker branding is visible on perimeter boards and shirts; 2) domestic TV audiences for those matches; and 3) TV advertising spots across selected sports channels on matchday. There are five metrics that we compare: search volume when TV advertising spots are placed on Sky Sports and BT Sport, at 1) 12-2pm, 2) 2-4pm, 3) 5-7pm; and search volume when sponsorship branding is visible during televised matches, at 4) 12.45pm KOs and 5) 5.30pm KOs.

We observed 27 Saturday games over 15 weeks to compile the 26 data points you see above. Of the 26 different data points, 15 show uplift in search volume during TV advertising or sponsorship exposure. Significantly, eight of the nine reductions in search volume are during TV ad spot periods - the one instance of reduction coinciding with TV sponsorship exposure (Bet365, 0.75 expected volume) was a 12.30pm KO on BT Sport that drew the lowest TV audience in our sample. Since January, Betfair branding has featured in 6 televised Saturday Premier League games in our sample (the highest among competitors), drawing an average of roughly 1m viewers per match. These televised matches coincide with a period of search uplift, averaging +58% during the early kick-off and +12% during the late kick-off. It is important to note that these uplifts are relative – Betfair yields a greater search volume than it would otherwise expect if marketing effects were removed, but in absolute terms, it still trails behind competitors as shown in charts 1 and 2. This is in part driven by competitor advertising: Bet365, Ladbrokes and William Hill ad spots each reached a greater cumulative audience than Betfair during Saturday advertising, and two of those three bookmakers see average search volume uplift during advertising periods.

An important distinction here is cost – ad spots are priced in proportion to the number of impressions, and these spots have roughly trebled in price since 2013, driven in part by ad-category exclusivity rules during breaks. On the evidence above, paying this premium doesn’t always yield an uplift in search volume. By contrast, sponsorship deals are typically a fixed fee; the propensity for broadcasters to air certain clubs more than others then dictates partner exposure. The top five teams by Premier League cumulative audience last season generated over four-times the viewership of the lowest five teams (and were broadcast live almost three-times as often), so while the evidence above broadly suggests that sponsorship is effective in driving search volume among our selected competitors, the TV viewership that clubs (and therefore sponsors) achieve varies wildly.

Cutting through the noise - be it via sponsorship, advertising or otherwise – is no small task. Ultimately, all bookmakers can expect see some uplift in search in absolute terms during matchday, but relative uplift is also crucial to the chasing pack if they hope to steal a greater share of voice.

Looking to the future

A bookmaker that engages in-stadia attendees, advertises live odds on LED perimeter boards mid-match, and sends push notifications during half-time when second-screen activity increases, is providing a call-to-action that converts a passive impression into an active one.

Of course there is merit in maximising impressions, both via sponsorship assets and TV spots. However, the scales of marketing budgets are tipping away from TV advertising and towards digital advertising. The betting landscape in the UK is becoming more crowded, bookmakers are engaging customers via more diverse touchpoints, and clubs are increasingly looking overseas for commercial partnerships – all of which make for an uncertain future for the traditional Premier League sponsorship model.

Gambling, by its nature, is often spontaneous and dictated by real-time events taking place. A bookmaker that engages matchday attendees via in-stadia activations, updates its live odds and advertises them on LED perimeter boards mid-match, while also sending push notifications to its customers during half-time when mobile and other second-screen activity increases, is providing a call-to-action that converts a passive impression into an active one. The timing of the message is as important as the reach.

Aside from the commercial aspect, some industries simply go out of fashion. A plethora of alcohol and electronics brands were en vogue during the nineties. Since 2010/2011 though, just one club per year has had an alcohol brand as their shirt sponsor. Conversely, up until 2006/2007, there had been only three instances of a bookmaker featuring on a club shirt, while this figure reached seven last season alone and rises to 10 this season. However, parallels have been drawn between betting and alcohol brands as both industries carry a stigma amid concerns over sporting heroes plying their trade with pro-gambling logos emblazoned on their shirts. Could betting partnerships suffer the same fate as their alcoholic counterparts?

Future trends in club partnerships remain to be seen, but one thing is for sure: the Premier League’s commercial clout continues to grow, and the sport as a whole continues to capture the imagination of punters…just ask fans of Leicester City and Wales.